China’s Tianqi Lithium Corp., the

country’s top producer of the battery metal, is facing mounting pressure to

repay over $6 billion in debt that helped it finance an ambitious expansion

overseas in the past two years.

A collapse in prices for lithium, used in the batteries that power electric vehicles (EVs) and high tech electronics, is mainly to blame, and it has taken an unexpected toll on the miner and its rivals.

Tianqi is due to repay in November a total of $2.2 billion to Citic Bank.

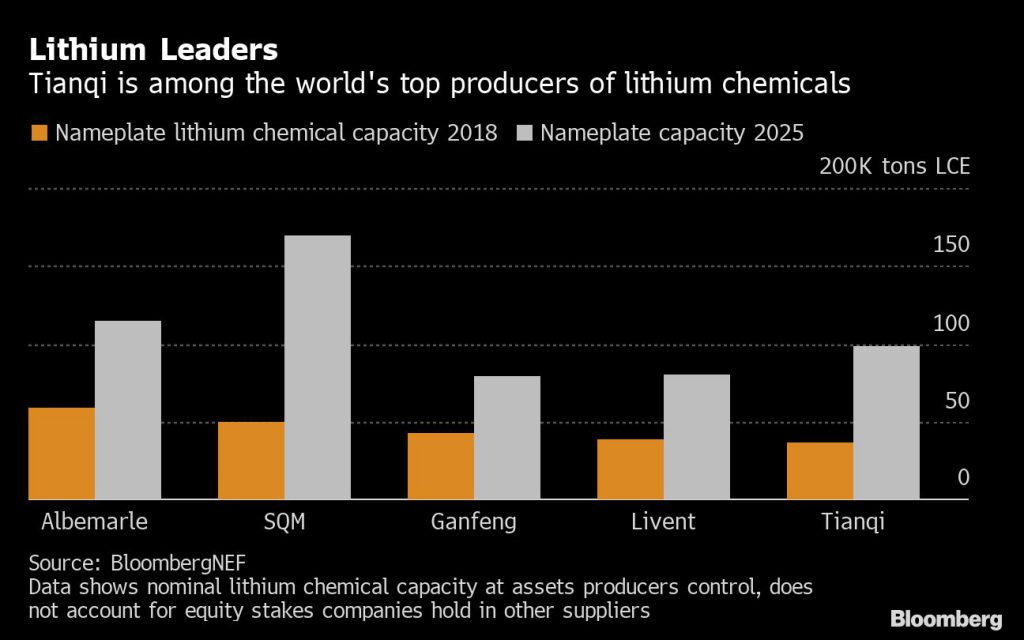

Albemarle (NYSE: ALB), the world’s No. 1 lithium producer, postponed in August plans to add about 125,000 tonnes of processing capacity. It also revised a deal to buy into Australia’s Mineral Resources’ (ASX: MIN) Wodgina lithium mine and said it would delay building 75,000 tonnes of processing capacity at Kemerton, also in Australia.

Chile’s Chemical and Mining Society (SQM), the world’s second largest producer of the metal, has also shown signs of distress, pushing back a key expansion at its Atacama salt flat operations from the end of 2020 to late 2021.

Canadian lithium miner Nemaska Lithium (TSX: NMX), which was backed by Japan’s SoftBank, filed for bankruptcy protection in December.

The main factor behind the price slump has been the avalanche of new supply that has hit the sector over the past year, triggered mainly by mine expansions and a cut in government subsidies for purchasers of EVs in China, the world’s largest market.

While long-term prospects for lithium are positive, with demand for the commodity expected to more than double by 2025, Tianqi has yet to find a way to cover a $3.5 billion loan from state-owned Citic Bank, $2.2 billion of which is due to be repaid in November.

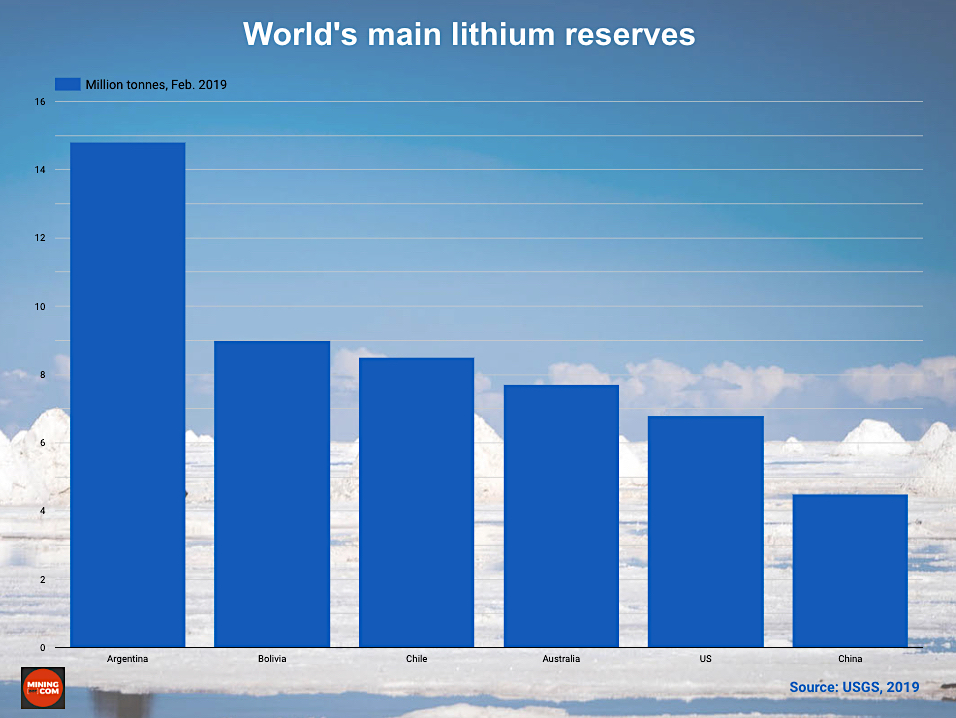

The Chinese miner used most of the loan to buy almost a quarter of SQM in 2018. It also grabbed 51% of Australia’s largest lithium mine, Greenbushes, last year and completed a $400 million lithium hydroxide processing plant outside Perth.

In December, Tianqi raised about 2.93 billion yuan ($424 million) in a rights issue, less half the 7 billion yuan it was seeking to help pay down the Citic loan.

As a result, Moody’s cut the miner’s rating to B1 from Ba3, saying smaller-than-expected proceeds from the rights issue would result in slower de-leveraging and tighter liquidity. Total debt will remain about 7.5 times its operating profit for the next 12 months, Moody’s estimated.

Last week, the company cancelled its bondholder meeting on worries about repaying investors. Its bonds fell to just over 64 cents on the dollar from around 75 cents days earlier.

With files from Bloomberg.