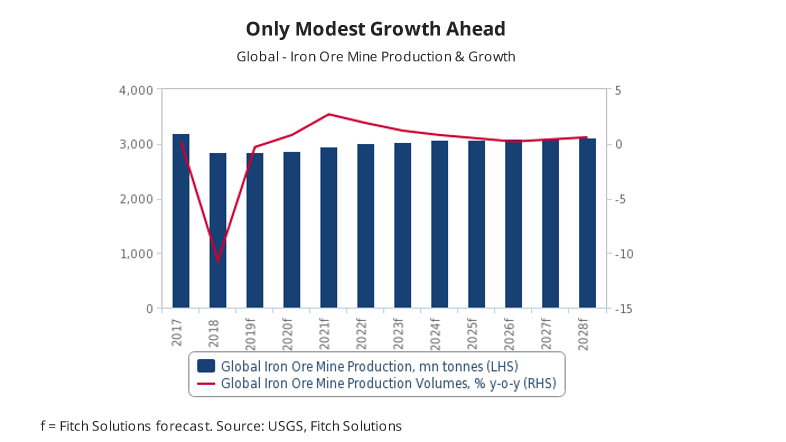

Global iron ore production will grow modestly over the years due to mine expansions in Brazil and increasing output from India, according to Fitch Solutions’ latest industry trend analysis.

Meanwhile, output growth in China will decline on the back of falling ore grades and high costs of production, analysts say.

Global iron ore production will grow modestly from 2,850mnt in 2019 to 3,119mnt by 2028, representing average annual growth of 0.9% during 2019- 2028, which is a significant slowdown from an average growth of 2.9% during 2009-2018, Fitch forecasts.

Analysts expect iron ore production in Australia to grow minimally during 2019-2028, averaging an annual 0.4% growth, compared with 10.4% growth over the previous 10-year period

Supply growth will be primarily driven by India and Brazil, where Vale is set to expand output with its new mine. Vale’s supply will continue to dominate global output, Fitch asserts. On the other hand, miners in China, which operate at the higher end of the iron ore cost curve, will be forced to cut output due to falling ore grades.

Fitch revised its 2019 iron ore production forecasts downwards for Australia from 903.6mnt to 882mnt due to Cyclone Veronica and other operational difficulties affecting output at major mines.

Analysts expect iron ore production in Australia to grow minimally during 2019-2028, averaging an annual 0.4% growth, compared with 10.4% growth over the previous 10-year period, due to mothballing of mines from junior miners, while major players will stick to their production growth targets to crowd out high-cost producers.

In April 2019, Rio Tinto lowered its 2019 iron ore production guidance by 14mnt as a result of Cyclone Veronica and a fire at its Cape Lambert port facility, followed by BHP who cut its iron ore production guidance for 2019 due to the impacts of tropical cyclone Veronica by 6.0-8.0mnt, Fitch reports. And in June 2019, BHP reported a return to full production capacity at its Western Australia Iron Ore (WAIO) operations, reflecting a 12% increase from March 2019.

Fitch expects Brazil’s iron ore production growth will rebound in the coming years following 2019, due to low operating costs and a solid project pipeline. Brazil will benefit from producing high-quality iron ore increasingly favoured by Chinese steel producers.

Fitch forecasts Brazil’s iron ore production to decrease to 443mnt in 2019 then return to growth, reaching 567mnt by 2028, averaging 1.5% compound annual growth.

The Brumadinho dam collapse sparked a flurry of investigations into Vale’s operations, leading to executive removals, idling operations, and fines on the horizon, Fitch says. The disaster triggered an initiative by Vale to decommission its remaining upstream tailings dams over the next three years, effectively cutting off 40mnt of iron ore per annum. Since the announcement, multiple operations have been idled, causing further supply disruptions.

The Brucutu mine was idled for six weeks, allowed to re-open, then idled again days later following another court ruling, then finally re-opened in June. Fitch expects to see continued regulatory scrutiny over Vale and the iron ore sector as the government grapples with the deadliest environmental disaster in the nation’s history.

Read the full report here.